I’ve decided to write about the real costs of advice to consumers, to dispel some of the myths and preconceptions.

As a forward, I thought I’d explain my misconceptions prior to getting involved in financial services sometime back in 2005.

A few years earlier price comparison websites had appeared in the market launching with the message that they “cut out the middleman” and offered better value to the customer by removing their “margin” on the deal.

So before I started working in mortgages I believed that a broker was someone who took a product, added their percentage on top and sold it on.

Since working in the industry though, I have realised there is a myriad of similar misconceptions floating around.

Some people think the arrangement fees on a mortgage deal are to pay the broker.

Some are convinced the lender will offer a better rate direct.

But are any of those assumptions even remotely based on reality?

Let’s start with the idea that middlemen just add margin onto a products price.

I’m a keen photographer and if you share my interest you might well be familiar with the absolutely awesome Sony a7 range.

I won’t waste your time taking you on a photography lesson. But I will show you what you already know.

This picture above is from the Sony UK website for an A7 with kit lens showing a retail price of £1509.00 today on 08-06-2018.

Now we have the same camera and lens on sale with a “middleman” called Jessops and it is, after cashback 50% of the list price on the same day.

Sony’s own retail shops are selling the body only for the same price Jessops offer with the kit lens and the lens is upwards of £400 on its own.

In short buying direct from the manufacturer could cost you twice as much.

But you already know this. You already know that the idea of middlemen adding cost to everything is a fallacy.

Distributors in every industry will often have superior deals. We all see this every day.

Most of us have seen Trivago girl a million times telling us how they compare all the different prices for thousands of hotels daily, but does anyone really think you would get the best deal by phoning the hotel?

So how does pricing in the mortgage industry really work? And how much does our advice cost you?

Lenders whose products are the same through every channel.

Some lenders offer the same range of deals through every channel and have made promises to the market to never do what we call dual pricing.

This means whoever you go to be it direct to the lender, or any broker the deals available will always be the same.

Examples of this are Barclays and Coventry Building Society but there are many others.

For these lenders, if the broker offers you a fee-free service the lender is paying the cost of our commission.

You need to be aware though, that we might recommend a product based on best value for money, and another adviser might just recommend the lowest rate.

You need to discuss with both parties to work out why two different deals might have been recommended.

But if you have access to all the same deals through both, then you cannot be paying the cost of advice unless the advisor is charging an additional fee.

And this should not be confused with a product booking or arrangement fee.

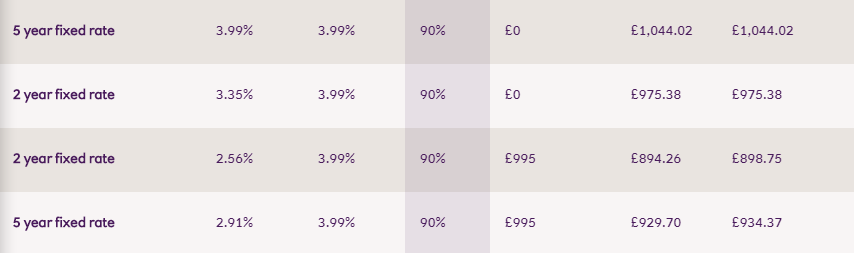

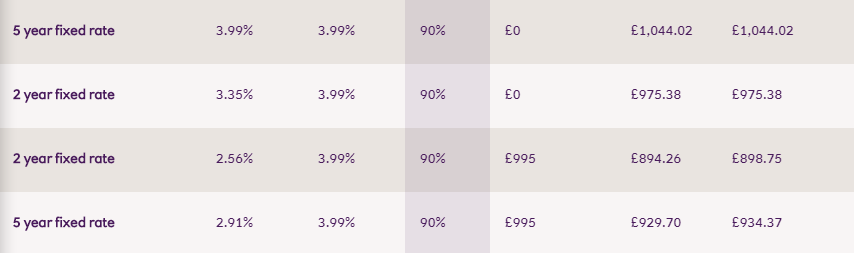

Lenders will usually release multiple rates at the same loan to value.

Some with a lower rate, and an arrangement fee (often around £999) and other deals with no arrangement fees and slightly higher rates.

This is just offering deals to appeal to different customers with different sized loans and has nothing to do with the broker.

You can see in the example below Natwest offering various two-year fixes with different fees and cash backs.

And the best value product for each customer would depend on their loan amount, term, whether it was a repayment mortgage, and whether they would have to add the fee to the loan.

Lenders who do offer different prices and product ranges.

Other lenders like Natwest, for example, do offer different ranges direct at times to those they offer through brokers.

So, the assumption is that using us is going to be more expensive, right?

Think again.

For various reasons lenders might offer much cheaper products via a broker than they do direct. As counter-intuitive as this may seem.

Below are two more screenshots from February this year.

Disclaimer – These rates and products were available in Feb 2018 but are used for example purposes only and are no longer available.

The first is from our sourcing system showing deals available with NatWest at 90% loan to value.

The product highlighted in black with yellow text and the product in blue text are both exclusive rates offered through various mortgage clubs for brokers at the time.

And then below are all the deals NatWest were offering to customers via their website at the same time.

Notice that our exclusive 2-year fixed was 0.5% cheaper than their direct deal, despite the lender paying us a commission of around 0.32% (the total is actually more as some will go to the mortgage club too).

So why on earth would the lender offer deals through brokers that in total cost them more than 0.82% in profits against their direct business?

You have to think about what we actually do because the lender would have to do all the same work.

That’s a professional adviser spending several hours on the phone to each customer. Hours spent processing documents, completing application forms, preparing compliance files and suitability reports.

They need the staff to cover this in a seasonal industry, so they would then have little to do half of the year. Those staff members go onto their pension scheme and pay national insurance and tax on their incomes.

They need to cover professional indemnity risks, telecoms cost, office space, computers, training, and development, staff turnover, and recruitment.

And then there is the fact that the broker market is also an advertising channel and comparative to paid advertising.

Now, this doesn’t mean that we will always have better deals with every lender. Often there will be little or no difference at all.

On occasion, their direct deals might be better.

Sometimes we will offer something a lot cheaper with the same lender. Other times our deals might not be as good.

Basically, there is no way to guarantee you get the best deal.

So the question really becomes one of time, stress, convenience and quality of service.

Do we end up pursuing the “best deal” when the cost of doing so outweighs the benefits?

I think the answer here comes down to the differences between using a broker and going direct.

In my view, with a good broker, you are going to be every bit as likely to get the best possible deal as you would be searching the market yourself with the difference being you don’t have to go through the hassle of doing that.

You’re also more likely to be protected from significant pitfalls.

I am going to follow this article with some others, one which highlights a life insurance provider whose contractual terms are so poor in comparison to their rivals I cannot justify recommending them and another one about the possible pitfalls of not taking advice.

Each article highlights how self-advising without a professional level of knowledge about implications like taxation, and different contractual terms could see you buy a cheap deal that incurs huge additional costs amounting to tens or hundreds of thousands of pounds over a lifetime.

Now we don’t want to scaremonger or imply that these risks apply to every transaction, but the point is to highlight the real benefits of advice that extend far beyond simply getting a good deal or better service and that even if that occasionally costs you more, it’s probably a cost worth paying for.

So make sure to come back and check out those articles over the next few weeks.

10-year fixed-rate mortgages have been reducing significantly in cost, and for the first time in the UK, it’s now possible to get a pretty competitive rate fixed for ten years. But the big question is should you get one?

Question 1: Is a fixed rate even appropriate for you?

Forget ten years. Should you even have a fixed-rate mortgage?

Lots of people get caught out by significant early repayment penalties due to not properly considering the question of their long-term plans before buying.

Will you be moving home, repaying large balances early, hoping to raise significant additional finance from the property or could you be eligible for better deals in the short term if your circumstances improve?

Before considering a fixed-rate mortgage, look at our guide to fixed-rate products and see how they work versus other rates. Pay real consideration to whether the points above could leave you paying redemption penalties of many thousands of pounds.

You should speak to an independent mortgage broker like us as well.

Question 2: Will fixing for ten years be competitive long term?

If you had a crystal ball, you could answer this question, but no one can see into the future.

When a lender prices a product, it’s either based on the cost of borrowing that money from another bank or investor and turning it into mortgages, or on the expected interest rate they will pay to their depositors over that time.

So the simple fact is that a fixed-rate mortgage will be priced based on the expectations of what will happen to interest rates over the term & the lender will expect to profit.

That means the current glut of competitive long-term fixed deals indicates that the banks expect a prolonged period of relatively low-interest rates in the UK well into the future.

So like odds given by bookies, most banks will not expect average interest rates over the fixed period to be higher than the rate they are offering you. So you are in effect betting against the bank, but they have been known to be quite spectacularly wrong in the past.

The smaller your mortgage though, and the shorter the remaining term (for someone on a repayment or capital and interest mortgage) the less differences in rate will impact the long-term cost.

Because of this, for each loan, there will come a point as the remaining term decreases when small differences in rates are outweighed by the repeated fees involved in refinancing a mortgage, and changing products regularly offers poor value for money.

This is very case-specific, but once your mortgage reaches that point the potential downsides of long-term fixes may become insignificant.

Question 3: So, who should take a 10-year fixed-rate mortgage?

If you are concerned about increases in costs, have no circumstances that might better suit variable rates, and are sure that the early repayment penalties won’t be likely to cause an issue, then you need to decide whether you feel it’s worthwhile gambling long term and risk paying more than you might need to, or whether to take a short-term product in the hope that you can secure another competitive rate again in a few years.

This decision is mainly going to come down to the margin between short-term fixed rates and long term ones. Also, the probability that changes to your circumstances make better deals available to you in the short term (such as better income making more competitive lenders available, or works to a property decreasing your loan to value), and whether you feel the additional cost is good value for the extra security.

A mortgage advisor such as ourselves will discuss your circumstances with you and give guidance on whether a fixed product is more appropriate for you. If a fixed rate is the best option for you, but it comes down purely to a decision between long and short-term deals then this is very much a decision best made by the customer, but at least we can present you with the best options available over the different periods so you can make a more informed decision between them.

If you’d like to know what the best deals available to you both in the short and long term could be then complete our enquiry form and an advisor will contact you, to discuss your options and provide you with advice.

Can someone over the age of 75 go on a mortgage?

Occasionally we are asked if we can arrange mortgages for elderly, or retired people of age 70, 75, 80 or even 90.

That will depend on the circumstances: whether the mortgage is for a buy-to-let or Residential property, if it is a joint application and if the income of the older applicant is necessary for affordability.

Most lenders for buy-to-let mortgages will have a maximum age of up to 80, but some have no maximum.

For Residential mortgages, where the income of the older applicant is required in the application, most lenders will not go beyond the age of 75-80. Many may be even more restrictive.

If it is a joint application with a younger applicant who can afford the mortgage in their own right, then some lenders will ignore the age of the other applicant entirely.

Other products available to seniors, such as ‘Lifetime Mortgages’ and ‘Home Reversion Plans’, may be more suitable, which work in very different ways to traditional mortgages and require specialist advice.

It is important to remember that all applicants on a mortgage would be responsible for the payments regardless of whether their income is used in assessing the case.

Therefore, as part of the advice process, we would consider arranging protection in case of death, illness or injury to either party.

To get expert advice, call 0345 4594490 or fill in our short enquiry form.

Probably the biggest mortgage-related question on everyone’s lips is whether to fix their mortgage and at present, it is certainly difficult to predict future interest rates.

I can remember a conversation with a client almost 18 months ago where media coverage suggested interest rates were going to shoot up, and they were worried the tracker product I had recommended might become very expensive.

In my opinion, whether to fix your interest rate or not is a two-part question. Firstly consider your attitude to risk and the severity of that risk.

If you have ample income to afford higher rates, it comes down to your preference of whether to gamble on variable-type products. But, if you cannot afford for your mortgage payments to go above current figures, you should not only be considering a fixed rate but also trying to reduce your borrowing levels asap.

The second part of the answer comes down to the difference between fixed rates and variable products. If the difference between a suitable variable product and fixed deals is relatively low, even if you are a risk taker, it may be worth opting for a fixed rate. However, with bigger differences, it becomes harder to say.

Let us compare a 5-year deal currently on offer with one lender of 6.49% with a 25% deposit to their 2-year fixed and 18month tracker product; this is 3-4% higher, and that means the chances of it being good value for money long term are much lower as it would require average interest rates over the next five years to be over 5% or so.

That is a significant increase from current rates, so I would only recommend a fixed in this scenario to someone on the borderline of what they could afford and needing absolute long-term security.

Many lenders are touting products with an option to switch to a fixed deal at a later date; without early repayment charges. But for those who would be at serious risk of being unable to afford their mortgage if rates went up, this is likely to be a poor option, as the fixed deals available at the time are likely to be higher then as well.

It remains likely that while interest rates must increase at some point, overall market competition will do too, and to some extent, increases in bank base rates are likely to be met with at least some reduction in lenders’ margins.

Current two-year fixed deals come with an average margin of about 3% over the bank base rate, which would have been unthinkable three years ago, so at some point, slowly but surely, these differences must be eroded by competition as the market improves.

There are thousands of concrete construction types in the UK; some of these are difficult, if not impossible, to mortgage.

In general, its properties from the post-war era and a pre-fabricated construction type that could be challenging to mortgage; however, even establishing the type of construction used can be troublesome.

Most properties built after 1984 are likely mortgageable; after this point, Building Regulations are widely considered to have delivered suitable construction methods and control of material standards.

Some concrete construction types, particularly those containing structural iron or steel, built between the early 1900s and 1970s, suffer from concrete corrosion and either require significant work to prevent failure or are unsuitable for a mortgage; whatsoever.

Classed as defective construction types, contaminants in the concrete react with the iron in the steel rotting the concrete and steel beams from the inside out.

Other construction types are classed as defective simply due to being built in large quantities with sub-standard materials; or experimental wall leaves that have performed poorly over time or failed systemically; the Large Panel System or ‘LPS’ being an example that catastrophically failed in the Ronan Point tragedy.

There are, though, common concrete construction types, such as Taylor Wimpey No-Fines, which are not usually a problem to mortgage.

If you are looking at buying a vintage property of a concrete construction type, you should inform your mortgage advisor at the outset.

They should be able to check with local surveyors and try to ascertain whether there are likely to be problems with a mortgage.

If an estate agent is advertising a property as a non-standard construction, requiring cash purchase; it is likely that the property is not typically mortgageable.

But you should not assume that any agent or vendor is aware of a non-standard construction type; this is one reason why having an independent survey, not just a basic-mortgage valuation, is generally prudent when buying a home.