Welcome to the brokers blog; where we discuss the latest developments, common queries, spurious sources and the sublime, ridiculous and esoteric aspects of the mortgage industry.

The coronavirus has caught governments, businesses and consumers off guard, so the situation is continuously changing, but there is good news for most people.

Firstly, for those who want to remortgage during the current lockdown, to consolidate commitments, or whose current deal is due to end soon, mortgage lenders are still lending, and our advice service goes on as normal. We can work with you entirely over the phone and online.

We will follow this article shortly with a discussion of the Bank of England Base Rate reduction and how this affects borrowers looking at a new mortgage. But for those with existing mortgage offers, there is further information below.

Due to the lockdown, most lenders have ceased physical valuations temporarily, so lending will likely rely on an electronic valuation (i.e. an estimate based on previous sale prices and local market trends, like estimates on sites like Zoopla).

That may mean you have difficulty if you have spent significant sums renovating a property and want to consolidate commitments into your mortgage.

Reports of lenders closing funding are based on a handful of small specialist lenders (new to the marketplace anyway) ceasing to offer new lending. Some larger lenders have limited their purchase lending loan-to-value limits, but purchasing currently seems unlikely.

Managing mortgage payments and difficulties in paying your mortgage

The most important thing for you as a consumer is that if you believe you will have difficulty paying your mortgage, you should contact your lender as soon as possible. Discuss with them the options they have for helping you manage payments.

On residential loans, i.e. properties occupied mainly by you or your family, the lender is legally obliged to try and prevent you from going into arrears.

That means they must consider offering solutions such as a temporary switch to interest only, if suitable, or consider alternatives like increasing the term or taking a payment holiday.

You should engage with them early as going into arrears will incur costs that may be non-refundable, avoidable, and any arrears recorded on credit reports are unlikely to be removed in future.

Arrears will also worsen future costs and the options available when you remortgage.

Bear in mind that any proposed solution will likely cost you more in the long term. So, it’s not a gift or freebie, and it may not make sense if you have plenty of savings to carry a short-term drop in income.

The situation is less clear for those with buy-to-let mortgages, especially as many will be interest only, and therefore, payment holidays are the only temporary solution available. It is unclear if the government’s statement about payment holidays will apply to commercial lending.

You should still contact your lender early to discuss what assistance they may offer if you are facing difficulties or non-paying tenants.

Lenders are unlikely to want to take punitive action against otherwise good borrowers for a problem that will affect them across their whole lending book, so they are likely to be magnanimous.

Registers of Scotland Shutdown

We have become aware of clients whose sales are pending soon and are experiencing difficulty due to the government closing the Registers of Scotland (the Scottish Land Registry).

Discussions between The Law Society and the Scottish Government are ongoing, and it seems likely that a solution is imminent. Until this point, Scottish sales will not be able to complete.

Bank of England Base Rate Changes

If you are considering a new mortgage, I will write shortly to expand on how the changes to the Bank of England Base Rate affect choices on new mortgage products.

For those people who are about to complete their mortgage soon, they present a dilemma.

Fixed-rate mortgages are unlinked to the BOE base rate, so the reduction in this has not yet passed through to most fixed-rate mortgages, although one or two drops have popped up.

As lenders will be extremely hard hit by the lockdown, they might seek to increase their margin on lending, so these rate reductions might never be passed onto fixed rates fully.

That means most borrowers can either wait to see fixed rates come down (when they could even go up) or switch to some form of variable product, such as tracker rates, which have reduced as they follow the BOE rate.

However, no one currently offers tracker or variable-rate mortgages with any cap or upper limit that I know of, and given that this is a time of unprecedented global turmoil, wild changes to interest rates are not outside of the realms of realistic possibility.

In this series, we’re exploring the hidden value of mortgage advice.

Often, when people think about the benefits of a mortgage advisor, the cliched norms of being whole of the market, having insider knowledge and getting the best deals are what spring to mind.

We like to think about getting a little off the rate, some lower arrangement fees or being guided on the pitfalls of certain products. But what about the transaction itself as a whole?

The real value of advice could be much more significant, like hundreds of thousands of pounds more.

We can all be a bit rate-obsessed and inclined to focus on the most apparent numbers, but the biggest risks to consumers are often those least apparent.

Most customers might only have one transaction in a lifetime where their choices may have such extreme consequences, but would you know enough to see those pitfalls when they exist?

Recently, I spoke to clients intending to buy a property in a sole name, as unmarried partners. And the potential impacts of that decision troubled me.

Like many customers, as his spouse had recently ceased employment, he thought it best to apply in sole name. Whether for simplicity’s sake or because he assumed it had to be a sole application.

Many people think that without an income, you cannot be an applicant; in truth, it would limit the maximum loan a little, but for most people, it is unlikely to jeopardise their application.

Anyway, that’s what a mortgage advisor is for, to advise, even if that means discussing two scenarios.

But this decision could have far-reaching consequences outside of mortgage lending, so I would immediately advise them to get tax, inheritance planning, and legal advice about other ramifications.

So what difference would it have made applying in sole names, and could it go monumentally wrong?

Now, we are not tax specialists, but my understanding of the tax position on this application would be as follows:

If you are neither married nor civil partners, you don’t benefit from joint inheritance tax thresholds totalling £650k, and you also lose the joint-main residence allowance totalling £1 million.

You can’t have joint ownership without a joint mortgage, and there is no such thing as a “common law” marriage outside of divorce settlements.

It’s fair to assume that tax allowances and property values will increase over time. But based on the purchase price of £600k and today’s tax allowances, we get an analogue of how future costs might stack up.

Whether or not they have a valid will, they may only use the applicant’s IHT allowance to pass the property onto children. As his partner never went onto the ownership of the property, her £325k allowance would effectively go unused if she died first.

In todays money, that would mean £110k of inheritance tax being liable by their children on death. However, if the applicant died first, leaving the whole property to his partner in his will, they could use both their allowances in series, but the two don’t combine in the way a married couple’s would; this could lead to paying even more inheritance tax.

So, a £110k payment would still be required, and that could force his partner to raise a lifetime mortgage or similar finance to pay the bill.

When she left the property to her children, the whole asset would be chargeable again, potentially leading to over £200k in inheritance tax plus any costs for financing the initial tax burden.

If they had arranged a suitable will, they could have avoided some of the tax by leaving half of the property value to the children and half to the partner, but ultimately still liable for the £110k.

That could also have its pitfalls to if the applicant died whilst the children were still minors (as raising any loan to pay the tax burden with a property co-owned by children is unlikely, if even possible).

If they had entered a joint mortgage, they could have split ownership 50/50 and used both of their £325k allowances to pass the property onto children with no IHT at all in today’s money.

Similarly, a civil partnership for tax purposes would allow larger benefits. That is relevant as it’s likely that this type of affluent customer ends up with further savings that may also pass to children, and could bear even more tax.

If they had arranged the mortgage in a sole name and had not made a valid will (its estimated that roughly 60% of people die without one), the consequences could be more dire.

If the applicant died first without a valid will, the ‘laws of intestacy’ would leave the property entirely to the children.

I am sure you can imagine that as the children would own the property (and if still minors, it would need to go into a legal trust to be held for them until they were 18), this scenario with a looming tax bill of £110k and a property you don’t technically own, would be about as much fun as DIY dentistry and something no one sane would even consider leaving as a possible pitfall.

There could be some benefits to keeping ownership in a sole name if the customers were likely to invest in other properties later, but this wasn’t the case at the time; either way, they would benefit from having been advised by a tax specialist so they could understand the options, and by a legal advisor so they would know the implications too.

One of those would also be that the partner was effectively gifting her deposit to the applicant and would likely need to sign various affidavits relinquishing her right to those funds, and residing in the property, potentially problematic in an acrimonious separation.

That all shows that arranging a mortgage can have wide-reaching technical consequences and huge financial impact, so if you’re working with a good adviser, you are much more likely to avoid catastrophe than if self-advising.

Whilst we aren’t tax or legal specialists, at least having someone with a moderate knowledge of the area is likely to catch situations that have huge risks attached and guide you to take further advice on those decisions that might be questionable.

I’ve decided to write about the real costs of advice to consumers, to dispel some of the myths and preconceptions.

As a forward, I thought I’d explain my misconceptions prior to getting involved in financial services sometime back in 2005.

A few years earlier price comparison websites had appeared in the market launching with the message that they “cut out the middleman” and offered better value to the customer by removing their “margin” on the deal.

So before I started working in mortgages I believed that a broker was someone who took a product, added their percentage on top and sold it on.

Since working in the industry though, I have realised there is a myriad of similar misconceptions floating around.

Some people think the arrangement fees on a mortgage deal are to pay the broker.

Some are convinced the lender will offer a better rate direct.

But are any of those assumptions even remotely based on reality?

Let’s start with the idea that middlemen just add margin onto a products price.

I’m a keen photographer and if you share my interest you might well be familiar with the absolutely awesome Sony a7 range.

I won’t waste your time taking you on a photography lesson. But I will show you what you already know.

This picture above is from the Sony UK website for an A7 with kit lens showing a retail price of £1509.00 today on 08-06-2018.

Now we have the same camera and lens on sale with a “middleman” called Jessops and it is, after cashback 50% of the list price on the same day.

Sony’s own retail shops are selling the body only for the same price Jessops offer with the kit lens and the lens is upwards of £400 on its own.

In short buying direct from the manufacturer could cost you twice as much.

But you already know this. You already know that the idea of middlemen adding cost to everything is a fallacy.

Distributors in every industry will often have superior deals. We all see this every day.

Most of us have seen Trivago girl a million times telling us how they compare all the different prices for thousands of hotels daily, but does anyone really think you would get the best deal by phoning the hotel?

So how does pricing in the mortgage industry really work? And how much does our advice cost you?

Lenders whose products are the same through every channel.

Some lenders offer the same range of deals through every channel and have made promises to the market to never do what we call dual pricing.

This means whoever you go to be it direct to the lender, or any broker the deals available will always be the same.

Examples of this are Barclays and Coventry Building Society but there are many others.

For these lenders, if the broker offers you a fee-free service the lender is paying the cost of our commission.

You need to be aware though, that we might recommend a product based on best value for money, and another adviser might just recommend the lowest rate.

You need to discuss with both parties to work out why two different deals might have been recommended.

But if you have access to all the same deals through both, then you cannot be paying the cost of advice unless the advisor is charging an additional fee.

And this should not be confused with a product booking or arrangement fee.

Lenders will usually release multiple rates at the same loan to value.

Some with a lower rate, and an arrangement fee (often around £999) and other deals with no arrangement fees and slightly higher rates.

This is just offering deals to appeal to different customers with different sized loans and has nothing to do with the broker.

You can see in the example below Natwest offering various two-year fixes with different fees and cash backs.

And the best value product for each customer would depend on their loan amount, term, whether it was a repayment mortgage, and whether they would have to add the fee to the loan.

Lenders who do offer different prices and product ranges.

Other lenders like Natwest, for example, do offer different ranges direct at times to those they offer through brokers.

So, the assumption is that using us is going to be more expensive, right?

Think again.

For various reasons lenders might offer much cheaper products via a broker than they do direct. As counter-intuitive as this may seem.

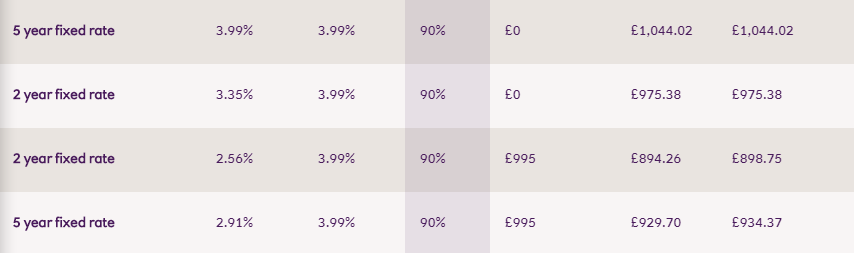

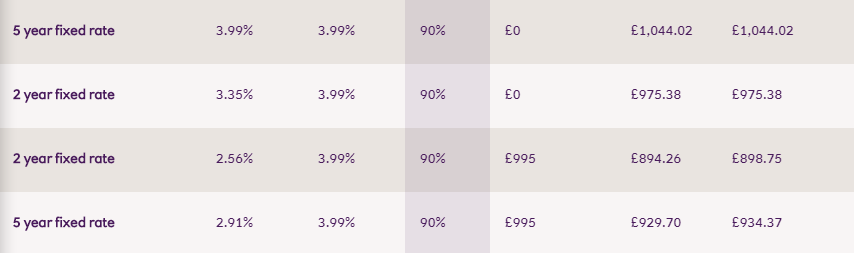

Below are two more screenshots from February this year.

Disclaimer – These rates and products were available in Feb 2018 but are used for example purposes only and are no longer available.

The first is from our sourcing system showing deals available with NatWest at 90% loan to value.

The product highlighted in black with yellow text and the product in blue text are both exclusive rates offered through various mortgage clubs for brokers at the time.

And then below are all the deals NatWest were offering to customers via their website at the same time.

Notice that our exclusive 2-year fixed was 0.5% cheaper than their direct deal, despite the lender paying us a commission of around 0.32% (the total is actually more as some will go to the mortgage club too).

So why on earth would the lender offer deals through brokers that in total cost them more than 0.82% in profits against their direct business?

You have to think about what we actually do because the lender would have to do all the same work.

That’s a professional adviser spending several hours on the phone to each customer. Hours spent processing documents, completing application forms, preparing compliance files and suitability reports.

They need the staff to cover this in a seasonal industry, so they would then have little to do half of the year. Those staff members go onto their pension scheme and pay national insurance and tax on their incomes.

They need to cover professional indemnity risks, telecoms cost, office space, computers, training, and development, staff turnover, and recruitment.

And then there is the fact that the broker market is also an advertising channel and comparative to paid advertising.

Now, this doesn’t mean that we will always have better deals with every lender. Often there will be little or no difference at all.

On occasion, their direct deals might be better.

Sometimes we will offer something a lot cheaper with the same lender. Other times our deals might not be as good.

Basically, there is no way to guarantee you get the best deal.

So the question really becomes one of time, stress, convenience and quality of service.

Do we end up pursuing the “best deal” when the cost of doing so outweighs the benefits?

I think the answer here comes down to the differences between using a broker and going direct.

In my view, with a good broker, you are going to be every bit as likely to get the best possible deal as you would be searching the market yourself with the difference being you don’t have to go through the hassle of doing that.

You’re also more likely to be protected from significant pitfalls.

I am going to follow this article with some others, one which highlights a life insurance provider whose contractual terms are so poor in comparison to their rivals I cannot justify recommending them and another one about the possible pitfalls of not taking advice.

Each article highlights how self-advising without a professional level of knowledge about implications like taxation, and different contractual terms could see you buy a cheap deal that incurs huge additional costs amounting to tens or hundreds of thousands of pounds over a lifetime.

Now we don’t want to scaremonger or imply that these risks apply to every transaction, but the point is to highlight the real benefits of advice that extend far beyond simply getting a good deal or better service and that even if that occasionally costs you more, it’s probably a cost worth paying for.

So make sure to come back and check out those articles over the next few weeks.

The internet is awash with misleading nonsense, out of context facts and the well intentioned leaving a wake of misinformation.

In this series we’re out to debunk the myths and illustrate the value of a decent mortgage advisor, and to highlight why you should be very careful about making decisions based on information from someone that is not an industry professional however esteemed a source they are.

Today I took a look at the following;

Mortgages for the self-employed – The Guardian

From the article;

“In general, the longer you’ve been self-employed, the better. If you have two years of accounts, you’ll have more choice of lenders; three years is even better. Most lenders insist accounts are prepared by a chartered or certified accountant.

Lenders will also want to see the income you’ve reported to HMRC and the tax paid. SA302 forms show this information, as does a “tax year overview” – HMRC can provide both.”

This is a prime example of most of the statements floating around the internet being part truth, but in this example they have actually got some seriously crossed wires.

The initial statement is completely valid. Most lenders do like 2 or even 3 years trading for self-employed applicants and suitable evidence of the performance of trading. Note the word most.

The final statement however, is extremely misleading.

Technically, it’s probably true. Most lenders would require “accounts” to be made up by a chartered or certified accountant.

The problem is though, most lenders don’t insist on using “accounts” as your proof of income, and most company owners may not even be aware of the difference between their HMRC tax returns and formal accounts.

The article implies that you are not only going to need formalised accounts from a chartered accountant but also your self-assessment returns.

The reality is lenders will usually be taking one or the other, and the type of self-employment may affect what they expect.

But for all types of self-employment there are still plenty of mainstream lenders who can accept just using your self-assessment returns with no need for an accountant to be involved regardless of the legal type of business (i.e. sole trader, partnership or limited company etc).

For the majority of sole traders or applicants in a bare partnership then the usual proof of income accepted by the majority of lenders is called an SA302 (a statement from HMRC declaring what income has been recorded on your submitted tax returns).

Most will also want to see accompanying tax year overviews that confirm whether your tax account is up to date.

There are also plenty of lenders who will accept this as a proof of income for shareholders of limited companies and limited liability partnerships.

Some lenders might insist for shareholders in LTD companies and LLP’s that formally made up accounts are used as proof of income and not SA302’s etc.

For those lenders they would then expect a professional accountant to have completed these.

So this article basically reads like you are going to struggle massively to get a mortgage if you’re not using an accountant. The reality is this is total nonsense.

The advice that more than one years of accounts is needed by most lenders is fair, although notably they go onto say that specialist lenders may be able to help those who only have a single year’s accounts.

We can direct you to high street lenders with normal interest rates anyone else would be offered with a single year’s accounts, and for those contracting on a day rate there could be options available from the high street with several more lenders.

So, directing people onto much more expensive non-high street lenders simply because they only have one year’s trading is again hugely misleading and could cause many people to “self-advise” into taking a much more expensive mortgage than was needed.

This article then is a great example of how someone writing who is not an industry professional can (with I’m sure the best of intentions) actually end up writing something that is downright dangerous, and simply not correct and will mislead people into poor decisions on a wholesale basis.

10-year fixed-rate mortgages have been reducing significantly in cost, and for the first time in the UK, it’s now possible to get a pretty competitive rate fixed for ten years. But the big question is should you get one?

Question 1: Is a fixed rate even appropriate for you?

Forget ten years. Should you even have a fixed-rate mortgage?

Lots of people get caught out by significant early repayment penalties due to not properly considering the question of their long-term plans before buying.

Will you be moving home, repaying large balances early, hoping to raise significant additional finance from the property or could you be eligible for better deals in the short term if your circumstances improve?

Before considering a fixed-rate mortgage, look at our guide to fixed-rate products and see how they work versus other rates. Pay real consideration to whether the points above could leave you paying redemption penalties of many thousands of pounds.

You should speak to an independent mortgage broker like us as well.

Question 2: Will fixing for ten years be competitive long term?

If you had a crystal ball, you could answer this question, but no one can see into the future.

When a lender prices a product, it’s either based on the cost of borrowing that money from another bank or investor and turning it into mortgages, or on the expected interest rate they will pay to their depositors over that time.

So the simple fact is that a fixed-rate mortgage will be priced based on the expectations of what will happen to interest rates over the term & the lender will expect to profit.

That means the current glut of competitive long-term fixed deals indicates that the banks expect a prolonged period of relatively low-interest rates in the UK well into the future.

So like odds given by bookies, most banks will not expect average interest rates over the fixed period to be higher than the rate they are offering you. So you are in effect betting against the bank, but they have been known to be quite spectacularly wrong in the past.

The smaller your mortgage though, and the shorter the remaining term (for someone on a repayment or capital and interest mortgage) the less differences in rate will impact the long-term cost.

Because of this, for each loan, there will come a point as the remaining term decreases when small differences in rates are outweighed by the repeated fees involved in refinancing a mortgage, and changing products regularly offers poor value for money.

This is very case-specific, but once your mortgage reaches that point the potential downsides of long-term fixes may become insignificant.

Question 3: So, who should take a 10-year fixed-rate mortgage?

If you are concerned about increases in costs, have no circumstances that might better suit variable rates, and are sure that the early repayment penalties won’t be likely to cause an issue, then you need to decide whether you feel it’s worthwhile gambling long term and risk paying more than you might need to, or whether to take a short-term product in the hope that you can secure another competitive rate again in a few years.

This decision is mainly going to come down to the margin between short-term fixed rates and long term ones. Also, the probability that changes to your circumstances make better deals available to you in the short term (such as better income making more competitive lenders available, or works to a property decreasing your loan to value), and whether you feel the additional cost is good value for the extra security.

A mortgage advisor such as ourselves will discuss your circumstances with you and give guidance on whether a fixed product is more appropriate for you. If a fixed rate is the best option for you, but it comes down purely to a decision between long and short-term deals then this is very much a decision best made by the customer, but at least we can present you with the best options available over the different periods so you can make a more informed decision between them.

If you’d like to know what the best deals available to you both in the short and long term could be then complete our enquiry form and an advisor will contact you, to discuss your options and provide you with advice.